Bharat Electronics Share Price Target 2024, 2025, 2027, 2030, 2040

If you think about which share will be best for investment in recent times then you should know about Bharat Electronics Share Price Target. Today in our blog we will explain the basic idea about Bharat Electronics Share Price Target 2024, 2025, 2027, 2030, 2040. We did the research and took advice from experts to make this blog about the company’s growth, performance, etc.

Bharat Electronics Share Price Target is a trading share in the share market. In this article, we will discuss the company’s financial growth, the business policy of the company, the shareholding pattern of the company, and the forecast share price yearly. We use expert data and analysis to understand Bharat Electronics Share Price Target. This article may be helpful to those who want to invest in this share right now. Let’s look at Bharat Electronics Share Price Target 2024 to 2040.

What Is Bharat Electronics Limited Company?

Bharat Electronics Limited is an Indian Government company attached to the manufacturing of aerospace and defence electronics company. The company was established in the year 1954. The headquarters of the company is situated in Bangalore. The company is under the Ministry Of Defence Of India.

Overview Of Bharat Electronics Limited

The company is attached to Aerospace, Avionics, Satellite Communication and Defence electronic products. The company owned Navratna status. In the year 1970 Bharat Electronics Company started to manufacture black & white TV picture tubes, microwave tubes, X-ray tubes, etc. The company started to manufacture radars and Tropo communication equipment in the Ghaziabad plant which was established in 1974.

| Company Name | Bharat Electronics Limited |

| MarketCap | ₹2,20,925.80 Crore |

| Book Value | ₹23 |

| Face Value | ₹1 |

| 52 Week High | ₹341.02 |

| 52 Week Low | ₹123.56 |

| P/B | 13.65 |

| DIV. YIELD | 0.74% |

History Of Bharat Electronics Share Price Target From 2024 to 2040

Bharat Electronics Share is a bullish trend in the share market. Bharat Electronics Share is under both the Indian Stock Exchange BSE (Bombay Stock Exchange) and NSE (National Stock Exchange). The last 6 month’s share growth was +112.50 (74.01%), the last 1 year’s share growth was +148.85 (128.71%), the last 5 year’s share growth was +228.40 (632.69%) and the maximum share growth was +264.28 (120,127.27%).

Bharat Electronics Share price return amount was 22.17% in the last 3 months, the last 1 year’s share return amount was 123.25%, the last 3 years’ share return amount was 407.26% and the last 5 years’ share return amount was 583.26%. If anyone wants to invest in the share it will be profitable on a long-term basis. Let’s have a look at Bharat Electronics Share Price Target From 2024 to 2040.

Also Read – Adani Enterprises Share Price Target

Bharat Electronics Share Price Target 2024

Bharat Electronics Company’s 2 different sectors are situated in Uttar Pradesh and Tamil Nadu which were established by the Government Of India. Bharat Electronics Company is qualified as a partner with ISRO for the manufacturing of small & micro Satellite Vehicles for India’s property. With the collaboration of ISRO, the company also planned for some new products like High Power TWTs, and LTTC-based substrates which are used in the Defence Sector.

| Year | Bharat Electronics Share Price Target 2024 |

| 1st Price Target | 250.26 |

| 2nd Price Target | 410.01 |

The company’s total revenue was ₹18,256.23 Crore in March 2023, which became ₹21,456.89 Crore in March 2024. The total operating revenue was ₹17,789.56 Crore in March 2023 which became ₹20,456.52 Crore in March 2024. If we look at Bharat Electronics Share Price Target 2024, the 1st Price Target is ₹250.26 and the 2nd Price Target is ₹410.01.

Bharat Electronics Share Price Target 2025

In the year 1989, the company started manufacturing telecom switching and transmission systems and built up Mass manufacturing units in Bangalore, in the first year the production units manufactured 75,00 electronic voting machines. In the year 1986, the company’s seventh unit was established at Kotdwara in which units the company manufactures Switching Equipment, and the eighth unit was established at Navi Mumbai to manufacture TV glass Shell.

| Year | Bharat Electronics Share Price Target 2025 |

| 1st Price Target | 415.85 |

| 2nd Price Target | 585.70 |

The profit growth of the company is also increasing. The last 5 year’s profit growth was 17.23%, the last 3 year’s share growth was 19.26% and in the last 1 year, it increased to 28%. The net profit amount was ₹2,425.89 Crore in March 2022 which increased to ₹3,345.56 Crore in March 2023. The operating profit amount was ₹3,325.74 Crore in March 2022 which became ₹3,999.52 Crore in March 2023. If we look at Bharat Electronics Share Price Target 2025, the 1st Price Target is ₹415.85 and the 2nd Price Target is ₹585.70.

Bharat Electronics Share Price Target 2027

The Indian-made guided missile air defence weapon system (Akash) is led by Bharat Electronics Company. The company was taken over by the Indian Government in the year 2019, in that year the company also launched new products and technologies such as high-data tactical radio, Airborne products like a radar fingerprinting system, Digital flight control computer, night vision devices, identification of friend or foe, etc.

| Year | Bharat Electronics Share Price Target 2027 |

| 1st Price Target | 815.63 |

| 2nd Price Target | 1005.52 |

The sales growth of the company is not so good. The last 5 year’s sales growth was 11.36% which became 10.98% in the last 3 years and in the last 1 year, it became 16.85%. The net sales amount was ₹15,456.85 Crore in March 2022 which became ₹17,785.96 Crore in March 2023. If we look at Bharat Electronics Share Price Target 2027, the 1st Price Target is ₹815.63 and the 2nd Price Target is ₹1005.52.

Also Read – Voltas Share Price Target

Bharat Electronics Share Price Target 2030

Bharat Electronics was the first defence PSU that owned the operational Mini Ratna Category Status in the year 2002. The Company’s Value of Production was ₹9,745 Crores in the year 2017-18 which increased to ₹11,852 Crore in the year 2018-19 which increased 24.12%. For more development of technology, the company invested a huge amount in the R&D sector. The invested amount was ₹997 Crore in 2017-18 which became ₹1,125 Crore in 2018-19.

| Year | Bharat Electronics Share Price Target 2030 |

| 1st Price Target | 1,489.63 |

| 2nd Price Target | 1,642.96 |

As Bharat Electronic is a very old company and has good market value the promoter holding capacity of the company is very good which is 51% to 52% which means many good investors want to invest in the share. As the company spread its business outside of the country the FII investor percentage of the company also increased is 17% to 18%. If we look at Bharat Electronics Share Price Target 2030, the 1st Price Target is ₹1,489.63 and the 2nd Price Target is ₹1,642.96.

Bharat Electronics Share Price Target 2040

The money turnover amount of the company was not bad. The turnover amount was ₹10,456 Crore in the year 2017-18 which increased to ₹11,898 Crore in the year 2018-19. To maintain good product services the company established 10 Regional Product Support Centres in overall India. In Andhra Pradesh, the company built up a plant which has a manufacturing capacity of IIR seekers, Thermal Imaging Camera, the plant is also expected to more growth for the coming years.

| Year | Bharat Electronics Share Price Target 2040 |

| 1st Price Target | 2,885.63 |

| 2nd Price Target | 3,045.11 |

The ROE percentage of the company also increased. The last 5 years’ ROE percentage was 21.36% which became 21.98% in the last 3 years and in the last 1 year, the percentage became 24.12%. The ROCE percentage of the company was 29.23% in the last 5 years, which became 29.1% in the last 3 years and in the last 1 year, it became 32.12%. If we look at Bharat Electronics Share Price Target 2040, the 1st Price Target is ₹2,885.63 and the 2nd Price Target is ₹3,045.11.

Peer’s Company of Bharat Electronics Limited

- Apollo Micro Sy

- Azad Eng

- Hindustan Aeron

- MTAR Tech

- NIBE

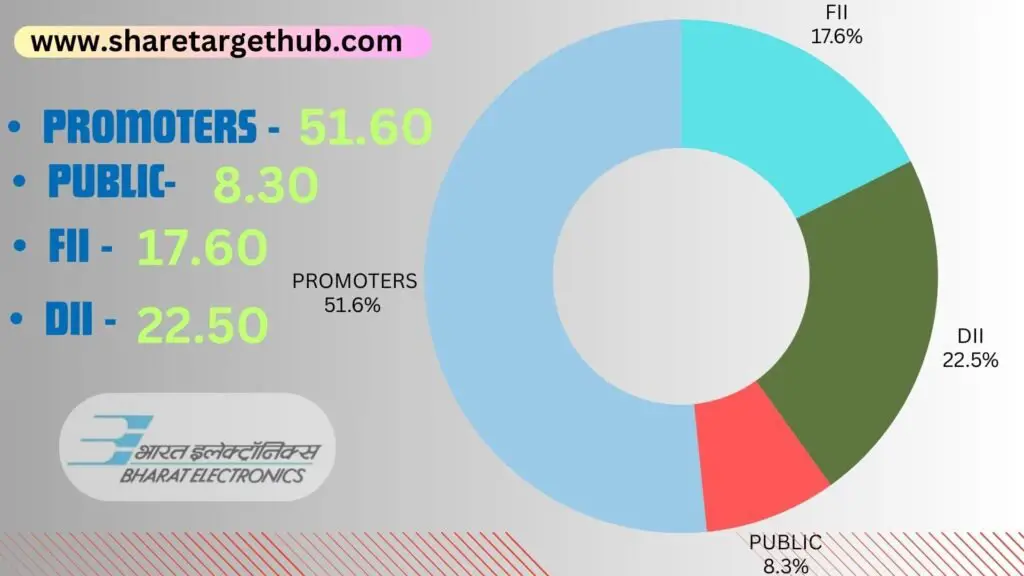

Investors Types And Ratio Of Bharat Electronics Limited

There are mainly Four main Types of Investors in Bharat Electronics Limited. The company’s growth also depended upon the ratio of investors who invested in the share.

Promoters Holding

Promoters Holding means how much capital is invested by company promoters (company owner) through overall capital. Bharat Electronics Limited Company’s promoter holding capacity is 51.60%.

Public Holding

Public Investors are individuals who invest in the public market profit in the future (large and small companies). Bharat Electronics Limited Company’s public holding capacity is 8.30%.

FII

Foreign Institutional Investors are those big companies that invest in different countries company. Bharat Electronics Limited Company’s FII is 17.60%.

DII

Domestic Institutional Investors (like Insurance, companies, and mutual funds) who invest in their own country. Bharat Electronics Limited Company’s DII is 22.50%.

Advantages and Disadvantages Of Bharat Electronics Share

Every share has some advantages and some disadvantages also. So, the Bharat Electronics Share Price Target also has some advantages and disadvantages described below.

Advantages

- The profit growth of the company increased, in the last 1 year’s profit growth was 28%.

- The company is increasing with zero promoter pledges.

- The company has a strong ROE percentage which is 24.12% in the last 1 year.

- The ROCE percentage of the company also increased which is 29.1% in the last 3 years.

- The company has a small amount of debt and has a healthy interest cover ratio which is 217.85.

- The promoter holding capacity of the company is high which is 51% to 52%.

- The company has good cash flow management PAT stands for 1.30.

Disadvantages

- The revenue growth of the company is not good which is 10.96% in the last 3 years.

- The company has a high EBITDA which is 31.25.

Also Read – Adani Ports Share Price Target

FAQ

Who Is the CEO of Bharat Electronics Limited Company?

Mr Bhanu Prakash Srivastava is the CEO of Bharat Electronics Company.

Is Bharat Electronics a government-owned Company?

Yes, Bharat Electronics is a Government-owned company under the Ministry Of Defence.

Should I invest in Bharat Electronics Share right now?

The last 6 month’s share growth of the company was +112.50 (74.015) and the last 1 year’s share price return amount was 123.25%. The FII investor percentage of the company also grew to 17.60%. Bharat Electronics Share gives good returns to investors. If anyone wants to invest in the share it will be profitable on a long-term basis.

What is the future growth of Bharat Electronics Limited?

The profit growth of Bharat Electronics Share is good is 28%, and the ROE percentage of the company is also good is 24.12%, as the company is very old company has a good promoter holding capacity which is 51.60%. The company spread its business outside of India also, and it will grow more in the coming future.

What is the Bharat Electronics Share Price Target for 2024?

Bharat Electronics Share Price Target for 2024 is ₹250.26 to ₹410.01.

What is the Bharat Electronics Share Price Target for 2025?

Bharat Electronics Share Price Target for 2025 is ₹415.85 to ₹585.70.

What is the Bharat Electronics Share Price Target for 2027?

Bharat Electronics Share Price Target for 2027 is ₹815.63 to ₹1005.52.

What is the Bharat Electronics Share Price Target for 2028?

Bharat Electronics Share Price Target for 2028 is ₹1,047.12 to ₹1,189.69.

What is the Bharat Electronics Share Price Target for 2030?

Bharat Electronics Share Price Target for 2030 is ₹1,489.63 to ₹1,642.96.

What is the Bharat Electronics Share Price Target for 2040?

Bharat Electronics Share Price Target for 2040 is ₹2,885.63 to ₹3,045.11.

Conclusion

Hopefully, www.sharetargethub.com will help you gain some basic ideas about the Bharat Electronics Share Price Target. By doing the research and taking advice from the experts we ensure that on a long-term basis, Bharat Electronics Share Price Target may reach a very high position. Bharat Electronics is mainly related to the manufacturing of aerospace and defence electronics Sector. So the demand for this sector also increases which helps the share to gain profit in the future.

If you think this website will be helpful for you then you can share it. If you have any questions please let us know through the comment box we will try to reply to your questions and solve your problem. Thanks for visiting this website and thanks for being with us.

Disclaimer – We are not SEBI-registered advisors. A financial market is always risky to anyone. This website is only for training and educational purposes. So before investing, we are requested to discuss certified expertise. We will not be responsible for anyone’s profit or loss.